Annual Enrollment 2021

I would like to preface this blog post by letting my readers know that this is my first year actively handling Medicare enrollments. For the past three years I have mainly operated in under 65 health market handling enrollments for both ACA/Obamacare and private health insurance providers. I did not really have any experience with Medicare prior to this year. During the pandemic and the long spell at home, I took up some good books that outlined the different benefits that Medicare offers to seniors.

To keep it short, I was very intrigued. I started thinking of all the seniors I come in contact with on a daily basis. I called up my grandparents and began asking questions about how they enroll, what plans their agents were offering and even what doctors their specific networks covered. What I found is that their are a lot of similarities between Medicare and traditional health insurance.

Medicare in most cases will cover 80% of inpatient hospital care, skilled nursing facilities, hospice, lab tests and home health care. The other 20% is either covered by the insured through copayments and coinsurance or through what is known as a Medicare Supplemental Insurance or Medigap. These supplements typically carry a monthly premium but make it so that the insured does not have to pay anything at the counter for their service. These Medigap plans are utilized by family members to ensure that the senior members of their families are receiving all of the car that they need, for one price that in some cases can be grandfathered in if plan offerings change.

So Why Does Everyone Always Mention Medicare Advantage?

One of the more common questions I get on a daily basis from potential clients is to identify the difference between Medicare supplements and Medicare advantage. Both offerings build upon the already existing coverage that Medicare provides, but what are the key differences that separate the two?

Below I have created a table to better depict some of the key differences between Medicare Advantage Plans and Medigap Medicare Supplements.

| Medicare Advantage | Medicare Supplement | |

| Can make changes | Two open enrollment periods per year | One period per lifetime unless there are special circumstances |

| Monthly premium | As low as $0 | Usually has a monthly premium |

| Part B deductible | May not have a deductible | Must pay unless you got Plan C or F before January 1, 2020 |

| Part B premium | Must pay | Must pay |

| Prescription drugs | Generally, covers | Does not cover |

| Routine dental, routine hearing, routine vision | May cover | Does not cover |

| Networks that restrict providers | Yes | No |

| Standardized benefits | No | Yes |

| Copayments and coinsurance | Usually has copayments and coinsurance | May cover all copayments and coinsurance |

From my limited experience, I would advise my clients to look into Medicare Advantage plans before agreeing to monthly premium payments that come with supplemental offerings. A lot of the Medicare Advantage plans that I deal with are $0 with pretty fair coverage limits for senior individuals with minor health problems. The real risk of Medicare Advantage Plans is that they do not offer the same level of choice as a Medicare with a supplemental offering attached. Enrollees with terminal illness or chronic disease may find that medical care costs rise significantly under a Medicare Advantage plan based on copayments and out-of-pocket expenses.

Any client of mine would be strongly advised to review the different copayments found within the summary of benefits. Paying $0 a month is enticing to some, but those costs on the backend for health care can really make or break an insured’s pocket book.

If you get sick in the middle of the year and exhaust all of your coverage, you are stuck with whatever costs you incur until you can switch plans during the next open season for Medicare. At that time, you can switch to an Original Medicare plan with supplement. If you do choose this option however, keep in mind that Medigap can may charge you a higher rate than if you had enrolled in a Medigap policy when you first qualified for Medicare. Most Medigap policies are issue-age rated policies or attained-age rated policies. This means that when you sign up later in life, you will pay more per month than if you had started with the Medigap policy at age 65. There are some policies that have no age rating requirement.

So I Should Choose A Supplemental Option Instead?

Before I answer the stated question let me take a moment to inform you that Medigap is additional insurance offered by private companies that you can buy to fill in the “gaps” of Original Medicare. While Original Medicare covers much of your medical costs, it still requires you to pay many fees such as copays, coinsurance, and deductibles. These fees can add up which leads many retirees to not be able to afford them. It is helpful to get an understanding of Medigap’s average monthly cost but your price will also depend on many different variables such as your age, zip code and which plan you select.

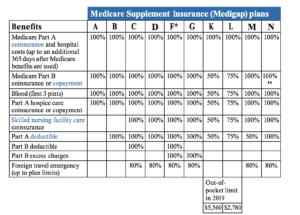

Below is a chart of the 10 different supplemental plan offerings that Medigap has available for seniors.

Most people not comfortable with Medigap’s monthly premium consider Medicare Advantage (MA). Unlike Medigap, MA replaces your Original Medicare. It doesn’t fill in all the gaps but it is usually less expensive.

| Medigap Pros | Medigap Cons |

| Plans cover all or part of Medicare additional fees | Monthly premiums can be pricey |

| Plans are easy to compare | Difficult to switch once enrolled |

| Guaranteed 6 month enrollment period when 1st eligible | May not be able to enroll after initial enrollment period |

| All plans offer an additional 365 days in hospital | Not all plans cover hospital deductible |

| Some plans offer extras like excess charges, foreign travel, and Silver Sneakers program | Does not include drug coverage |

| Nationwide coverage | Doesn’t cover acupuncture |

So Which One Is Best For Me?

Truthfully, each individual is unique and has there own set of circumstances that may make one product more appealing then the other. What’s most important is that you understand what is being offered and how what’s being offered will be beneficial to you. I hope this post was a great starting point, but as always, you should consult with an agent for any further questions and concerns.